Your UK Pensions Taxes In Portugal Easily Explained

Thinking of retiring to Portugal? It’s a dream for many Britons, but don’t overlook the tax side of things.

If you receive UK pensions, understanding how they’re taxed in Portugal is essential. This guide explains what to expect, how to plan, and where to seek help.

UK Pensions Taxes: What Changes When You Retire to Portugal?

When you become a Portuguese tax resident, your UK pensions may no longer be taxed in the UK (with some exceptions).

Most types of pension income are instead taxed in Portugal. The way this works depends on the kind of pension you have.

1. UK Pensions Taxes: Government Service Pensions

If you worked in the UK civil service or for a local authority, your pension will remain taxable in the UK.

These pensions are exempt from Portuguese tax, even if you’re a resident in Portugal.

Important: NHS pensions do not fall under this category. They are taxed in Portugal like private pensions.

2. UK Pensions Taxes: State Pension

Once you retire to Portugal, your UK State Pension is taxed only in Portugal.

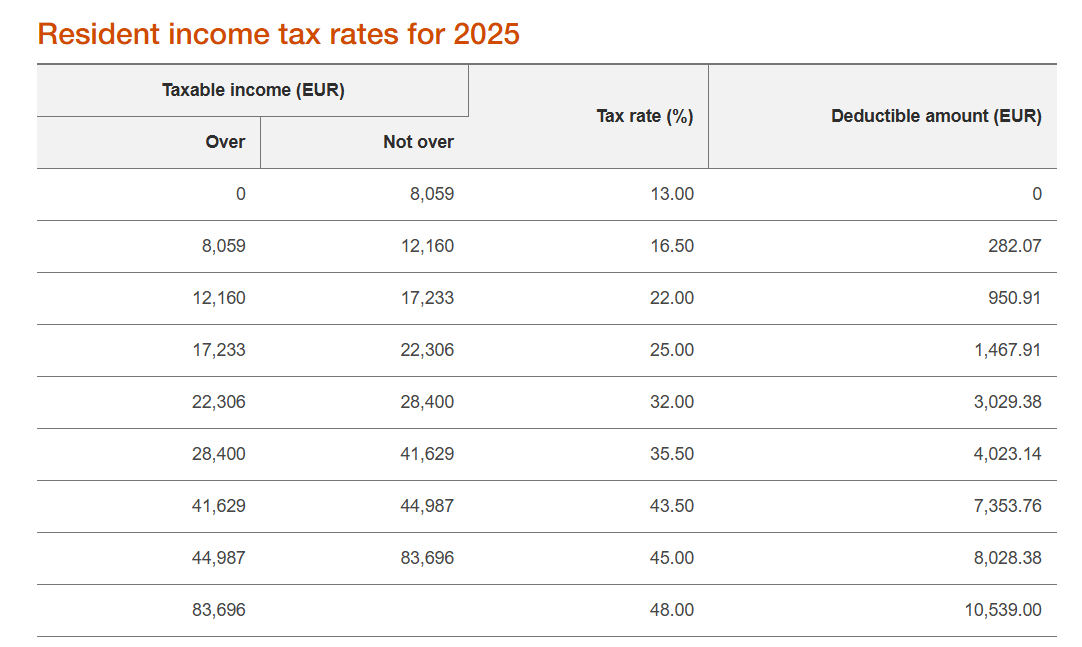

It is taxed at Portuguese income tax rates, which range from 13% to 48% depending on your total income.

If you’re married or in a de facto relationship, you may opt for joint taxation to reduce the rate.

3. UK Pensions Taxes: Occupational Pensions

Employer pensions (occupational pensions) are considered regular income in Portugal.

They are taxed at progressive income tax rates, just like employment income.

4. UK Pensions Taxes: Personal Pensions (SIPPs and SSAS)

If your personal pension includes employer contributions, it is taxed as deferred employment income.

If fully funded by personal contributions, treatment may be more favourable:

- Your original contributions may be tax-free.

- Growth or investment income is taxed at 28%.

If it’s not possible to identify the contribution split, tax may follow life insurance rules:

- Years 0–5: 28%

- Years 6–7: 22.4%

- Year 8 onward: 11.2%

5. Pension Lump Sums

In the UK, you can usually take 25% of your pension tax-free.

In Portugal, this does not apply. Pension lump sums are taxed as regular income.

If you’re planning to take a lump sum, consider doing so before becoming a Portuguese tax resident.

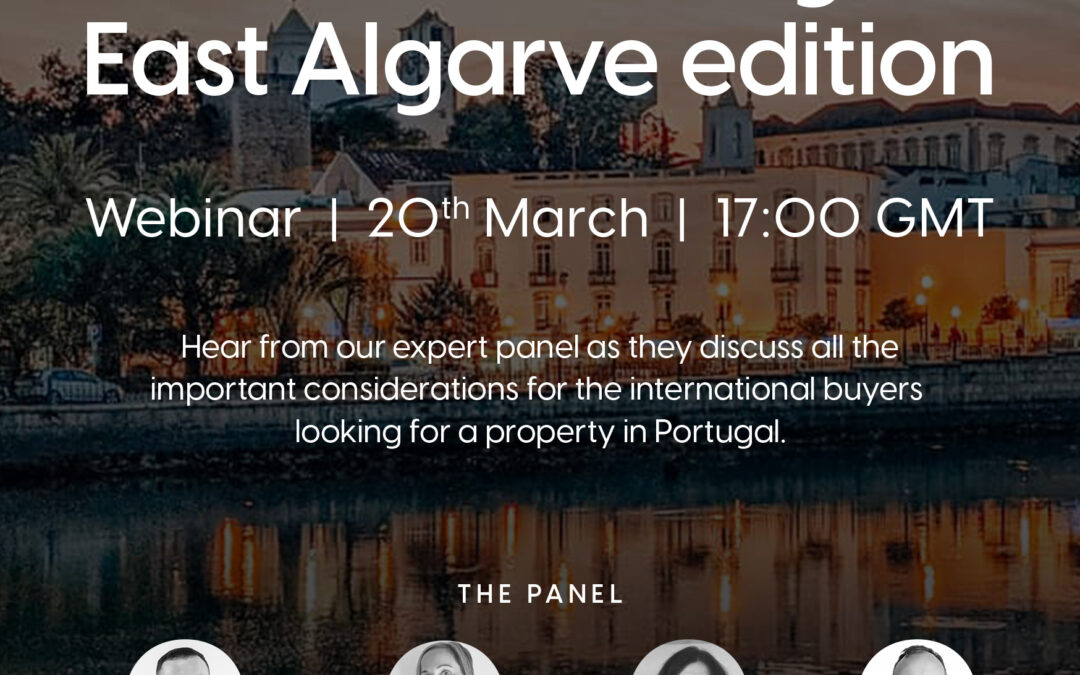

6. The NHR Scheme and UK Pensions

Portugal’s Non-Habitual Residence (NHR) scheme offers tax benefits for new residents:

- Registered before 31 March 2020: most foreign pensions may be tax-free.

- Registered after April 2020 (before closure): UK pensions taxed at a flat 10%.

Note: Government pensions are always taxed in the UK, even under NHR.

7. Tax on Investment Income

Other retirement savings and investments may also be taxed:

- Dividends, interest, and capital gains: taxed at 28% flat rate.

- Option to apply progressive income tax rates if more favourable.

Some investment wrappers and life insurance products may reduce your tax exposure under Portuguese law.

Explore more on our page: Portuguese Compliant Investments

Why Reviewing Your Pension Matters

Retirement planning doesn’t end when you move abroad.

Tax laws change. Markets shift. Your goals evolve.

Regular reviews with a qualified financial adviser help keep your plans compliant and tax-efficient.

Final Thoughts

Retiring to Portugal offers sunshine, outdoor living, and a slower pace of life at lower cost.

But your UK pension tax obligations change when you relocate.

Get advice, plan ahead, and stay informed for a secure retirement abroad.

Key Takeaways:

- Government service pensions are taxed in the UK only.

- State and personal pensions are taxed in Portugal.

- NHR may reduce your tax on foreign pensions.

- Lump sums are not tax-free in Portugal.

- Investment income is taxed at 28%, with flexible options.

Speak to a qualified cross-border financial adviser for tailored guidance.