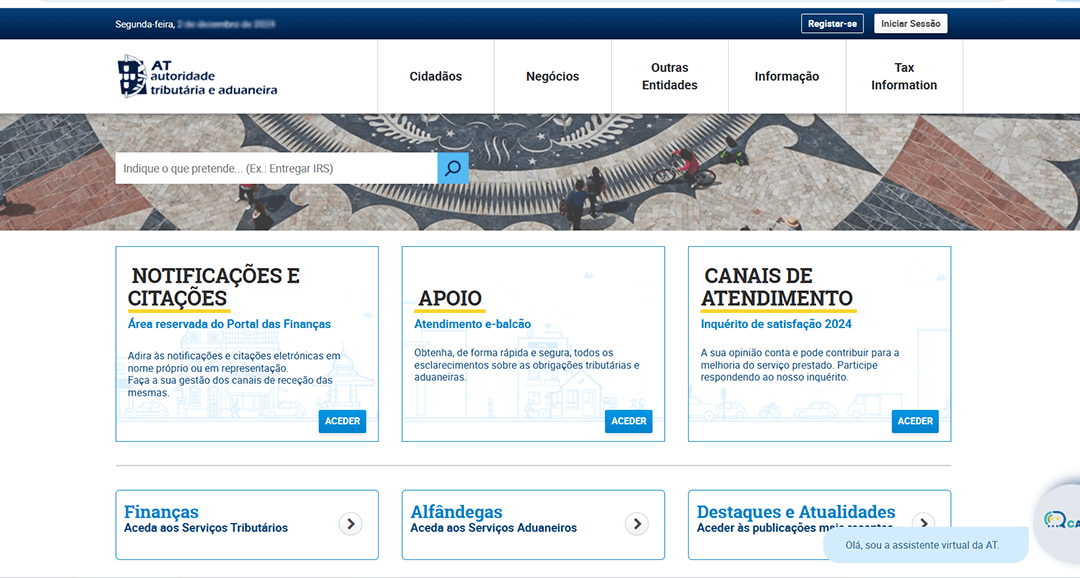

The Financial Portal in Portugal, commonly referred to as the Portal das Finanças, serves as a crucial online resource for individuals and businesses to manage their tax and financial obligations in Portugal. It is designed to streamline interactions with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira). This user-friendly platform eliminates the need for frequent visits to tax offices by providing a comprehensive suite of online services. Whether you’re a resident, non-resident, or business owner, this guide will help you understand the portal’s features, registration process, and its value.

What is the Financial Portal in Portugal?

The Portal das Finanças is the official platform of the Portuguese Tax Authority (Autoridade Tributária e Aduaneira). It allows users to efficiently manage taxes, track financial information, and access essential tax-related services. With its centralised approach, the portal is indispensable for tasks such as filing tax returns, requesting tax certificates, and paying property or vehicle taxes.

Accessing the Portal das Finanças: Registration Explained Simple

For Residents:

Visit https://www.portaldasfinancas.gov.pt/

Choose Registar-se in the top right corner.

Choose Registo NIF, input your NIF number and confirm by pressing Registo NIF.

Fill out the required information.

Password Delivery: Upon successful registration, your password will be sent via post to your registered Portuguese address. Check your post box in about two weeks after the application. There is no option to receive the password via e-mail, sms, etc.

Use this password for your initial login.

About NIF number

NIF is your tax number, ‘número de identificação fiscal’ or ‘número de contribuinte’. Usually, you obtain NIF number while applying for residency in Portugal. A non-resident needs to have a fiscal representative (individual or collective) to obtain NIF. Applying for a NIF is free of charge. Necessary documents: Identification document.

For Non-Residents:

Non-residents engaging in financial activities in Portugal, such as property ownership, can also register. However, they are typically required to appoint a fiscal representative. This representative ensures compliance with Portuguese tax laws and acts as a liaison with the tax authorities.

Note: While the portal can send the initial password to international addresses, delays are common. A fiscal representative can simplify and expedite this process.

Why a Fiscal Representative Might Be Necessary

A fiscal representative is an otion for:

Non-residents conducting financial activities in Portugal.

Individuals with tax obligations but no Portuguese residential address.

Fiscal representatives handle correspondence with the tax authorities and ensure compliance with tax regulations, providing peace of mind to those residing abroad.

Are you looking for a fiscal representative or experiencing difficulties with the portal da finanças? Contact Ingenim Financial and we connect you to our trusted partners who can assist.

Want to know more about NIF? See our article here.

Services Offered by the Financial Portal in Portugal (Portal das Finanças)

The Portal das Finanças provides a wealth of services, empowering users to handle a variety of tasks efficiently. Here are some key functionalities:

- Tax Returns (IRS):

File your annual income tax return with ease. The portal often provides pre-filled forms, making the process quicker and more accurate.

- VAT and Corporate Taxes:

Businesses can use the portal to declare and pay VAT or corporate taxes, ensuring compliance with reporting deadlines.

- Property Tax (IMI):

View, calculate, and pay your annual property tax. The platform also notifies users of upcoming payment deadlines.

- Vehicle Tax (IUC):

Car owners can manage their annual vehicle tax directly through the portal, avoiding delays or penalties.

- Tax Compliance Certificates

Request official certificates for proof of tax compliance, often required for financial transactions like loans or real estate dealings.

- Expats and Foreign Income:

Expatriates can declare foreign income and apply for benefits such as the Non-Habitual Resident (NHR) tax scheme, which provides tax incentives for new residents.

- Obtaining other references and declarations

From the financial portal Portugal you can obtain and download Proof of Address, Certificate of Tax Residency, Income Declarations and Statements, and more.

Benefits of Using the Financial Portal in Portugal (Portal das Finanças)

The Portal das Finanças is a vital tool for anyone interacting with the Portuguese tax system. Its benefits include:

Convenience: Conduct all financial and tax-related tasks online.

Transparency: Easily access detailed records of your tax obligations and payments.

Efficiency: Avoid long queues at physical tax offices by completing processes digitally.

Common Issues and Support Options

If you face issues such as forgotten passwords or difficulty accessing the portal:

Use the password recovery feature on the portal, ensuring your address on file is correct.

Contact the Portuguese Tax Authority support team at +351 217 206 707 for assistance.

Visit a local Serviço de Finanças for in-person support if required.

See the contact information of the offices of Serviço de Finanças in Algarve:

Direcção de Finanças de Faro

Cmte. Francisco Manuel 3A, 8000-269 Faro

Floor 0. Municipal Market of Faro

Mon.-Fri. 9:00 – 4:30 pm

Serviço de Finanças de Loulé 1

Address: R. das Portas do Céu 854, 8100-522 Loulé

Mon.- Fri. 9:00 -3:30 pm

Serviço de Finanças de Loulé 2

Address: R. São Tomé e Príncipe 254, 8125-507 Quarteira

Mon.-Fri. 9:00 am – 3:30 pm

Repartição de Finanças de Albufeira

Address: 184, R. das Telecomunicações 2, Albufeira

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de São Brás de Alportel

Address: R/C, R. Boaventura Passos 8, 8150-121 São Brás de Alportel

Mon.-Fri. 9:00 am – 3:30 pm

Repartição de Finanças de Olhão

Address: 8700-371 Olhão

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Tavira

Address: 4 8801-, R. Amália Rodrigues 3, Tavira

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Castro Marim

Address: r/c, R. de São Sebastião 12, 8950-122 Castro Marim

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Vila Real de Santo António

Address: R. de Angola 39 A 1º, 8900-271 Vila Real de Santo António

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Silves

Address: R. Cândido dos Reis 1 R/C, 8300-126 Silves

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Lagoa

Address: 8401-852, R. do Viveiro 5, 8400-418 Lagoa

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças em Portimão

Address: R. Fernando da Piedade Dias Castelo B, 8500-506 Portimão

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Lagoa

Address: 8401-852, R. do Viveiro 5, 8400-418 Lagoa

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Monchique

Address: b, R. Serpa Pinto 35, 8550-467 Monchique

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Vila do Bispo

Address: 407, Vila do Bpo.

Mon.-Fri. 9:00 am – 3:30 pm

Serviço de Finanças de Aljezur

Address: R. 25 de Abril 93, 8670-088 Aljezur

Mon.-Fri. 9:00 am – 3:30 pm

Repartição Finanças de Alcoutim

Address: Av. de Duarte Pacheco 2, 8970-071 Alcoutim

Mon.-Fri. 9:00 am – 3:30 pm

Conclusion

The Financial Portal in Portugal, or Portal das Finanças, is a game-changing resource for managing financial and tax-related matters in Portugal.

Trusted partners of Ingenium Financial provide full-range support in any issue you might experience with financial portal or the Tax and Customs Authority office. Find out how we cooperate with other professionals and get in touch for more information.