British Expats: Hurry Up To Report Your Portugal Residency Now

Why you should report your Portugal residency (& Portugal address) to the UK Authorities ASAP in order to potentially save your children a great deal of money?

Introduction: A Crucial Move for British Expats in Portugal

If you are a British expatriate living in Portugal, you can reduce your inheritance tax bill by hundreds of thousands of pounds (depending on the size of your estate).

Following UK budget changes announced last October being liable for UK inheritance tax became a great deal clearer and for those already overseas or thinking about moving away from the UK there is a significant upside but only if you make sure that you properly inform the UK that you are resident elsewhere.

Many UK citizens move and leave their financial affairs in the UK. They are in a familiar place, perhaps they work well. Other assets like pensions are there and it seems like a lot of work to find alternatives overseas. However this convenience and sometimes apathy now needs seriously considering and perhaps immediate change.

Looking for a cross-border financial advice? Chartered Financial Adviser in Portugal here.

How the UK Budget of October 2024 Changed Inheritance Tax for British Expats in Portugal

Previously it was very hard to escape UK Inheritance Tax (IHT), even if you spent a long time living abroad. Everything changed with the recent UK budget (Oct. 2024). Some significant changes were implemented as to how UK inheritance tax was assessed. That’s where your Portugal residency declaration becomes important.

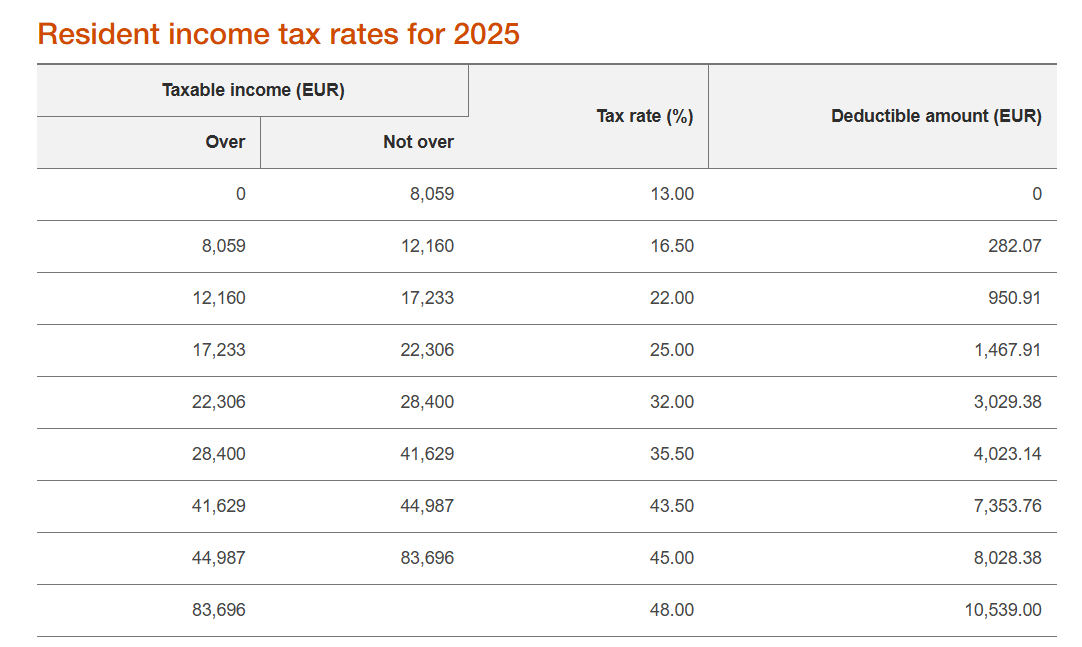

Put simply, there is no inheritance tax in Portugal. The UK levies a 40% tax on assets (now including private pensions) over and above some allowances.

Even if you make clear your residency overseas, UK based assets remain within the scope of UK IHT assessments.

Once more, even if an investment portfolio is based ‘off-shore’, any investments within it that are based in the UK (e.g. A FTSE 100 company share) would be subject to assessment.

Real Example: A British Couple in Portugal Unknowingly at Risk

Let’s imagine a situation, a British couple retired to Portugal 10 years ago. They are living abroad, receiving UK pensions, and paying UK tax on them but not too much to be bothered about. They use their child’s or relative’s UK address as a correspondence address with HMRC. Pension Trustees pay taxes on your behalf, deducting them at source form your income.

They do not report their Portugal residency or Portugal address to the UK (HRMC), as they want to avoid extra paperwork and the associated hassle. They may have informed their bank about their new Portuguese address considering it was enough.

Although this may seem harmless, it’s a critical oversight. Without formally notifying HMRC of their Portuguese residency, the couple risk being deemed UK resident and having 100% of their assets assessed for UK IHT – that includes their house in Portugal.

Their heirs could face a hefty inheritance tax bill in the UK unnecessarily.

Looking for tax efficient solutions to securely house your assets without being overcharged? We have a solution!

Why Declaring Your Portugal Residency and Address Matters Now

Now starting from the 6 April 2025 , if you’ve been resident outside the UK for 10 years or more when you die, your non-UK assets will not form part of your estate for IHT assessment.

Sounds good? Yes, if your Portugal residency and address was correctly reported in advance and you have not fallen foul of any ties assessed by the UK’s Standard Residency Test’

For some additional explanation see the section called ‘Long-term Resident’ from Accountants KPMG here;

Budget: The new look inheritance tax | KPMG UK

The scope of inheritance tax (IHT) in the UK is fundamentally changing from a domicile-based system to a system based on residence. From 6 April 2025, the test for whether non-UK assets owned by individuals and trustees are within the scope of IHT will be whether the individual, or very broadly for trusts the individual settlor of the trust, is a ‘long-term resident’.

kpmg.com

Portugal’s Inheritance Rules: 0% Tax on Direct Heirs

Unlike UK, Portugal does not levy inheritance tax on direct ascendancy, be it property or other assets. Put another way, 0 % Inheritance tax.

British Expats in Portugal: How to Declare Your Portugal Address and Residency to HMRC

Your residence in Portugal and Portuguese address should made clear and reported to the UK as soon as possible. You should avoid paying tax in the UK and make clear to all authorities that you are not resident in the UK.

Complete online or paper DT -individual form here;

Inform your pension provider, financial institutions, and any UK-based service providers of your Portuguese address to maintain consistency.

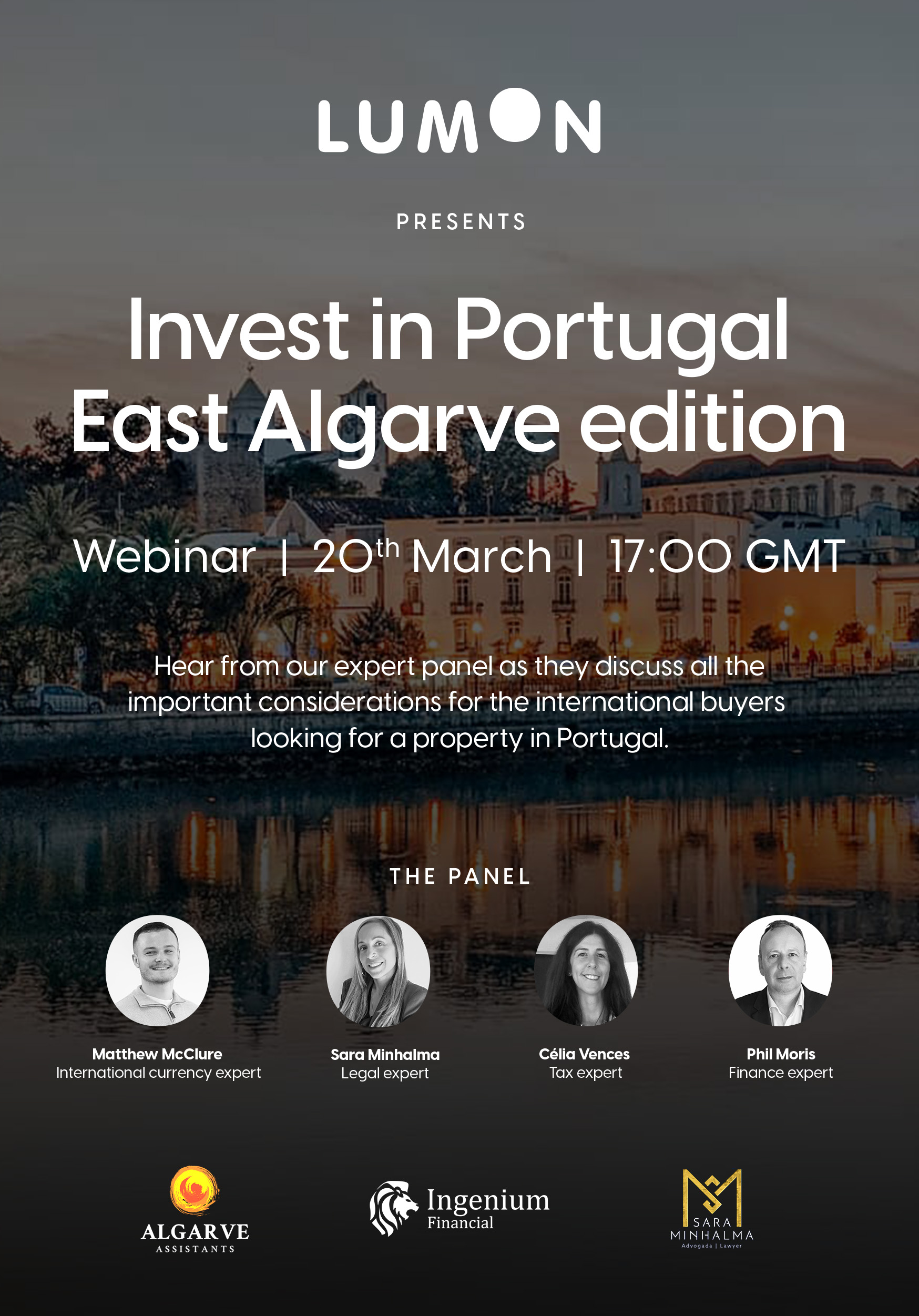

Still in process of getting Portugal residency? It’s better to start planning ahead. Contact Ingenium Financial to ensure a smooth transition.

Conclusion

If you’re a British expat living in Portugal, properly declaring your residency and address to HMRC can mean the difference between your children inheriting the full value of your estate or facing a significant tax bill.

With Portugal offering 0% inheritance tax to direct heirs, and the UK no longer taxing non-UK assets for long-term non-residents, the opportunity to protect your legacy is real — but only if you act.

Complete your DT-Individual form today, notify HMRC of your Portuguese address, and ensure your estate stays in your family, not in the hands of the tax office.

This is a complex subject and some aspects of the new rule changes have been simplified as they fall outside the scope of this general article and its length. You are urged to seek professional advice from a Chartered Financial Adviser.

Looking for a professional opinion on your situation? Get in touch for an in-depth complementary review.