British Nationals In Portugal And The 90-day Rule: Fundamentals

Following Brexit, British nationals visiting Portugal are now subject to the Schengen 90/180-day rule—just like other non-EU citizens. If you’re planning to travel to Portugal, it’s important to understand how this rule works and how to stay compliant.

What Is the 90/180-Day Rule?

The Schengen 90/180-day rule allows you to spend up to 90 days within any 180-day period in the Schengen Area—including Portugal—without needing a visa. These 90 days can be taken in one stretch or split over multiple visits. This applies to holidays, house-hunting trips, or short stays before settling in more permanently.

Why It Matters to British Nationals in Portugal

Portugal remains a top destination for British nationals moving abroad, thanks to its beautiful climate, relaxed pace of life and attractive tax advantages. So if you’re not yet a resident, you’ll need to manage your visits carefully.

Overstaying—even unintentionally—can result in serious consequences, such as:

-

Monetary fines

-

Deportation

-

Temporary bans from the Schengen Zone (up to 3 years)

Example: How the Rule Works in Real Life

Imagine you arrive in Portugal on 1st January. That date begins your personal 180-day period. You’re allowed 90 days within that timeframe—either consecutively or split over a few trips. Once you’ve used up your 90 days, you must leave the Schengen Area and wait until your 180-day window resets before returning.

Need help tracking your days? Use a Schengen calculator (https://www.visa-calculator.com/, https://schengensimple.com/ etc.) or a travel diary app ( Day One , Polarsteps, Travel Diaries or any other) to stay on top of your timeline.

How to Count Backwards from Your Current Date

A helpful way to calculate how many Schengen days you’ve used is to count backwards 180 days from the date you intend to travel (or are already travelling). Then:

-

Add up all the days you’ve spent in the Schengen Area (including Portugal) during that 180-day window.

-

If the total is under 90 days, you’re still within the rules.

-

If you’re at or close to 90, plan carefully—your next trip may need to wait.

🧮 Example: If you want to enter Portugal on 1 September, look back 180 days (to 5 March) and count every day spent in the Schengen Area during that time. That’s your total.

This rolling calculation ensures that your 90 days don’t need to be consecutive, but they must stay within any given 180-day slice of time.

British Nationals in Portugal: Can You Stay Longer?

Yes, but you’ll need to apply for the correct visa or residence permit depending on your intentions. Common reasons for extended stays or relocation include: retirement, working, family reunification or living off passive income (e.g. pensions or investments) etc.

Most British nationals apply for residency before they move, so forward planning is key.

👉 Interested in long-term solutions? Discover tax-efficient strategies and Portuguese-compliant investment options → here.

Learn more about visas and residency in Portugal for British nationals from the UK government.

British Nationals in Portugal:

What If You Overstay Due to a Medical Emergency?

Life happens, and sometimes plans change due to health-related reasons. If you’re forced to overstay because of a serious illness or medical emergency:

-

Gather evidence: hospital discharge letters, medical certificates, or cancelled flights

-

Notify the British Embassy without delay

-

Cooperate fully—each case is reviewed on its individual merits

Seeking advice from a relocation expert or legal advisor is also highly recommended.

Entry Rules for UK Citizens

When entering Portugal (or any Schengen country), your UK passport must:

-

Be less than 10 years old

-

Remain valid for at least 3 months beyond your intended departure date

Make sure your passport is stamped when entering and exiting. If a stamp is missing, be ready to show travel receipts (e.g. boarding passes) and request that border officials manually log your entry or exit.

You May Also Be Asked For:

-

Evidence of return or onward travel

-

Proof of your accommodation (booking or ownership)

-

Financial means (e.g. recent bank statements)

Schengen vs. the EU: What’s the Difference?

Not all EU countries are part of the Schengen Zone, and vice versa. For example:

-

Ireland is an EU member, but not in the Schengen Zone

-

Switzerland, Norway, Iceland, and Liechtenstein are Schengen members, but not in the EU

Portugal is part of both, making it a strategic and appealing destination for UK citizens.

What’s Coming Next? The EU Entry/Exit System (EES)

The European Union plans to launch the Entry/Exit System (EES) in October 2025. This digital system will automatically record the movements of third-country travellers, including British nationals, into and out of the Schengen Area.

Keep up to date to avoid any surprises at the border.

Final Thoughts: Stay Smart, Stay Within the Rules

If you’re among the many British nationals in Portugal—whether visiting, investing, or preparing for residency—respecting the 90-day rule is absolutely essential. With the right planning, you can enjoy a smooth and stress-free transition.

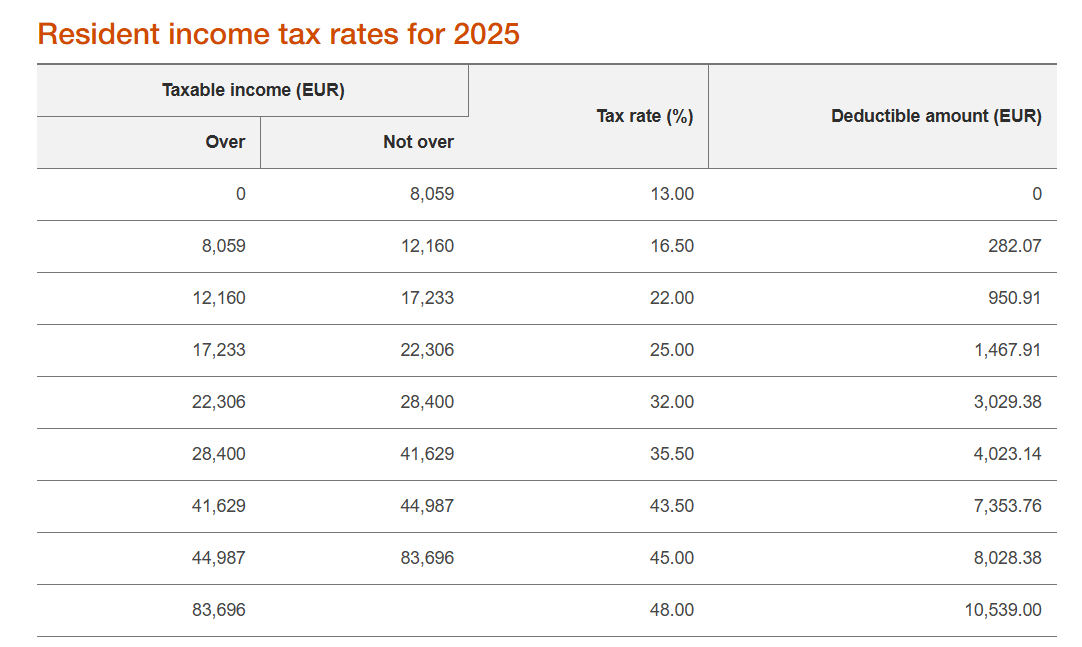

Moving to Portugal? Let’s Make It Financially Smart

Planning your move to Portugal? Ensure your assets travel just as smoothly as you do. With support from a Chartered Financial Adviser who operates on a lean, transparent fee structure, you can benefit from tailored, cross-border advice that considers both UK and Portuguese systems. From tax optimisation to wealth planning, we help British nationals navigate the financial landscape with confidence and clarity. Get in touch→ here.